Executive Summary:

The iKnowit/Intellisophic AI strategy reframes the multi-trillion adTech market for next gen search around winning the AI race by dominating the most valuable, reachable segments with semantic targeting instead of chasing the entire market with another LLM. The product is a semantic DSP–SSP powered by a verified knowledge graph that matches advertiser intent to user context (e.g., “durable backpacks” yields ads for lifetime-warranty hiking gear), delivering higher relevance and measurable lift.

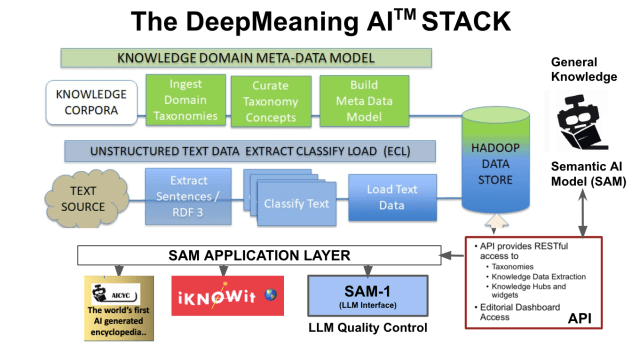

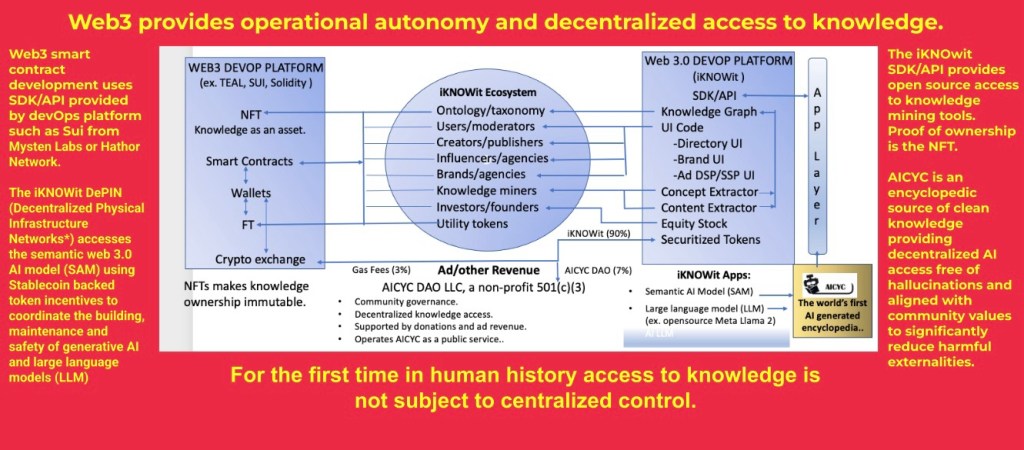

The specific compute platform is a CRYPTO-Web3-native Physical Infrastructure Network (DePIN), using a Solana blockchain due to its high throughput and low transaction cost. Intellisophic provides the open API and DePIN interface to intellisophic’s DeepMeaning AITM Stack as a Knowledge-as-a-Service (KaaS).

The iknowit supported DAO community maintains the semantic AI model (SAM); operates a public benefit project (AICYC.org) bringing clean knowledge to human and AI consumers. Utility tokens handle payments, staking, and voting, while stablecoin settlements (USDC/DAI) shield participants from volatility, unlock emerging-market demand, and let the treasury earn 4–8% DeFi yield to reinforce reserves. Novel but necessary blockchain conceots like Maximal Extractable Value (MEV) are discussed in separate addendum below.

Monetization blends protocol fees (1–3% of ad spend), data licensing (anonymized insights as NFTs), and staking/yield. Pricing captures premium ROI from semantic targeting, with microtransactions for SMBs. The go-to-market plan targets Google’s weakest flank: advertisers frustrated by AI hallucinations and low relevance. The promise is 2–5× higher CTR via verifiable targeting, 15% underbids on high-intent keywords, and a publisher guarantee of 30% higher revenue through real-time token payouts, audience insights, and archive monetization.

Risk is mitigated with zero-knowledge privacy, licensed custodians, on-chain ad verification, and overcollateralized stablecoin pools. The roadmap:

Years 1–2 launch SAM-1 with Web3 integration and capture 5% of premium verticals (pharma/luxury);

Years 3–4 reach ~15% share in contextual ads and integrate with 50+ e-commerce platforms;

Year 5 target 20% of digital ad spend and become publishers’ default search ads partner.

Macro thesis: as LLMs mediate buying, 60–80% of the $1T digital ad market could shift to LLM-centric channels over 5–10 years—fewer but higher-quality, premium-priced ads. SAM positions as the “fat protocol” for this transition, distributing value to creators (45% allocation) and governed by a DAO (25% strategic pool). Growth assumptions include MAUs scaling from 2.5M to i18.2M (64% CAGR), rapid publisher and enterprise onboarding, and token value accrual through utility and governance. The Semantic Ad Marketplace lets LLMs act as both consumers and publishers of ads, with $SEMAD tokens backed by stablecoins and smart contracts enforcing quality, creating a defensible, network-effect moat.

I. Semantic Knowledge Infrastructure for DSP-SSP Interchange

- Demand Side Platform (DSP) Ad Buyer::

SAM has stored a verified knowledge graph indexing every e-commerce website product/supplier attributes: ad space inventory, specs, sustainability, reviews. - Supply Side Platform (SSP) Contextual Ad Placement System:

Matches ad buyers to user intent using semantic reasoning (e.g., “durable backpacks” → hiking gear ads with lifetime warranties).

II. Web3 Semantic AI Model Knowledge Platform

Making Search and AI Decentralized and Immutable

- iKNOWit provides the opensource API and maintains the DePIN Code interface.

- Intellisophic provides the DSP/SSP UI.

- The AICYC user community builds and maintains the semantic AI model (SAM) and Web 3.0 protocol.

III Tokenomics Architecture:

- Utility Tokens: Payments for ad buys, data licenses, staking.

- Incentives:

- Publishers: Earn tokens for contextual data.

- Users: Token rewards for engagement.

- Advertisers: Stake for premium targeting.

- Borderless Operations:

Use blockchain to bypass geo-restrictions and payment friction.

IV. Stablecoin Integration

1. Volatility Shield:

- Advertisers pay in stablecoins (USDC, DAI); auto-convert to $ADS for protocol fees

- Implement overcollateralized pools to ensure token value stability during market fluctuations

- Create price stability mechanisms to protect both advertisers and publishers from crypto volatility

2. Capital Efficiency:

- Treasury yield farms stablecoins on DeFi protocols (Aave/Compound) for 4–8% APY

- Reinvest yield to strengthen protocol reserves and fund ongoing development

- Maintain strategic reserves to manage liquidity during high-growth periods

3. Emerging Market Access:

- Stablecoin settlements enable hyperinflation-market advertisers (e.g., Argentina, Turkey) to participate

- Bypass local currency controls and banking limitations through blockchain-based payments

- Create frictionless global advertising marketplace regardless of local economic conditions

4. Monetization Engine:

- Revenue Streams:

- Protocol Fees: 1–3% on ad spend.

- Data Licensing: Sell anonymized trend insights as NFTs.

- Staking/Yield: Earn from liquidity pools and DeFi.

- Pricing Strategy:

- Premium fees (20–50% higher) for semantic targeting ROI.

- Microtransactions for SMB advertisers.

5. Market Disruption Playbook

- Google Attack:

Target advertisers frustrated by AI hallucinations. - Offer 2–5× higher CTR via SAM-1’s verifiable targeting.

- Underbid Google Ads by 15% for high-intent keywords.

- Publisher Onboarding:

Guarantee 30% higher revenue via: - Real-time token payouts.

- Audience insights from SAM-1’s belief system.

- Monetize archives.

- Global Scaling:

Partner with e-commerce platforms (Shopify, Amazon) for live inventory indexing.

6. Risk Mitigation

- Regulatory:

- Zero-knowledge proofs for privacy compliance.

- Partner with licensed custodians (e.g., Anchorage).

- Fraud Prevention:

On-chain ad verification via smart contracts. - Volatility Control:

Stablecoin hybrid settlements + overcollateralized pools.

7. Execution Timeline

- Year 1–2:

- Launch SAM-1 DDS-SSP with Web3 integration. Alpha code and design complete.

- Capture 5% of premium ad verticals (pharma/luxury).

2. Year 3-4:

- Dominate contextual advertising (15% market share).

- Integrate with 50+ e-commerce platforms.

3. Year 5:

- Volatility Shield:

Advertisers pay in stablecoins (USDC, DAI); auto-convert to $ADS for protocol fees. - Capital Efficiency:

Treasury yield farms stablecoins on DeFi (Aave/Compound) for 4–8% APY. - Emerging Market Access:

Stablecoin settlements enable hyperinflation-market advertisers (e.g., Argentina, Turkey).

- Control 20% of digital ad spend.

- Replace Google as default search ads partner for publishers.

IV. The Ad Revenue Shift to iKNOWit.

The shift from human-focused to LLM-mediated advertising represents a profound transformation of the $1T digital ad market. Here’s how we might estimate this transition:

Market Shift Estimation

The $1T digital ad market would likely transform in phases:

- Initial Adoption (1-2 years): 10-15% shift ($100-150B) as early adopters integrate LLM-mediated purchasing

- Acceleration (2-5 years): 30-50% shift ($300-500B) as the model proves effective

- Maturity (5-10 years): 60-80% shift ($600-800B) as LLM purchasing becomes standard

Ad Demand Impact

The overall ad demand would initially decrease but eventually increase:

Initial Decrease Factors:

- LLMs filter out low-value/irrelevant ads, reducing wasteful spending

- More efficient targeting eliminates redundant ad purchases

- Consolidated purchasing patterns reduce competitive bidding wars

- New meta-advertising targeting LLM decision algorithms

- Premium pricing for guaranteed LLM visibility

- Competition to influence LLM recommendation algorithms

- New ad formats designed specifically for LLM interpretation

1. LLM Owners as E-commerce Customers

This creates a crucial dynamic: LLM providers (like OpenAI, Anthropic) would have dual roles as both ad platforms and major customers. This would:

- Create potential conflicts of interest requiring regulation

- Establish powerful first-party data advantages

- Potentially lead to vertical integration of ad networks and e-commerce platforms

The end result would likely be a more efficient but potentially more concentrated ad market, with higher-quality but fewer total ads, commanding premium pricing for those that effectively influence LLM purchasing decisions.

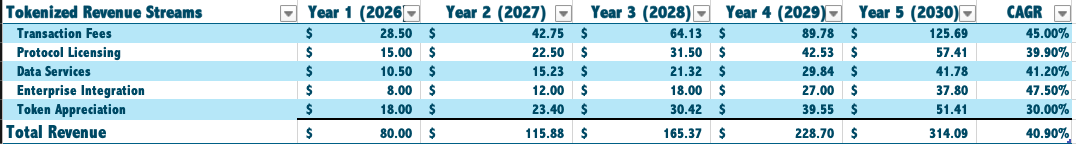

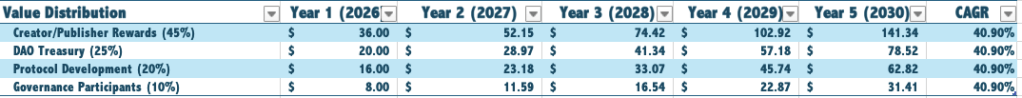

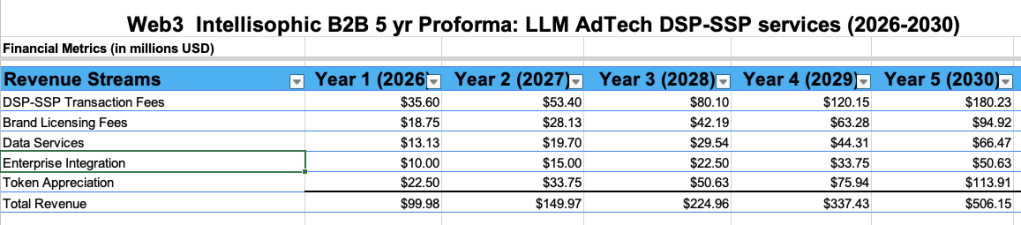

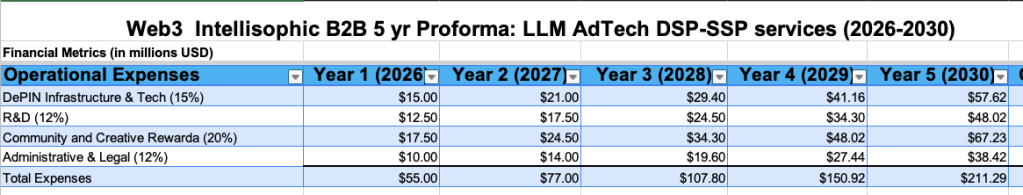

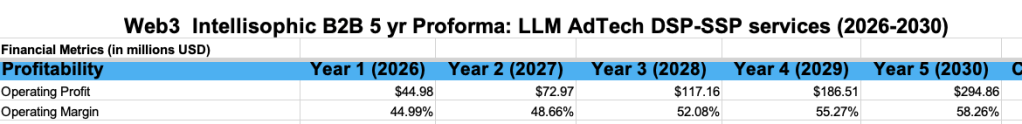

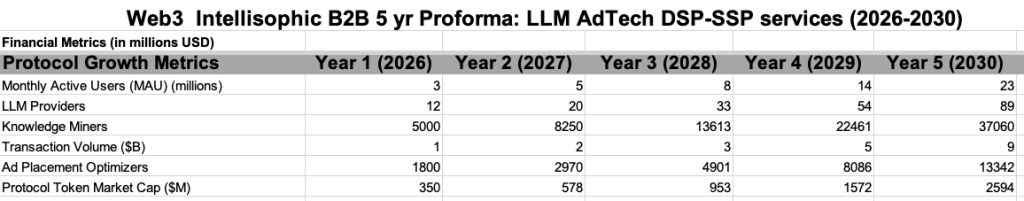

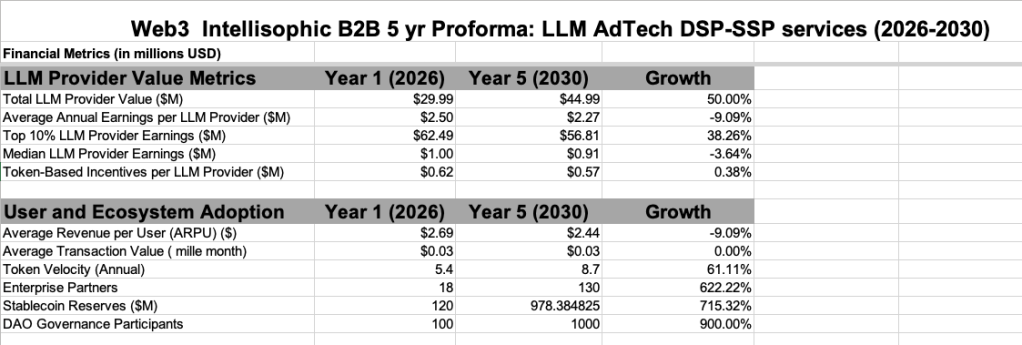

Web3 Fat Protocol 5-Year Proforma (2026-2030)

Financial Metrics (in millions USD)

Tokenized Revenue Streams

Value Distribution

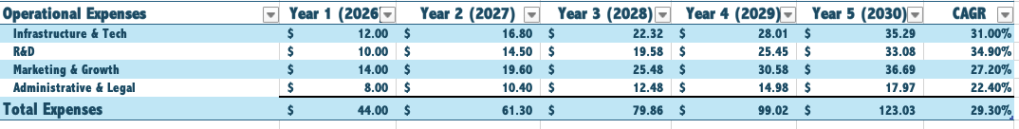

Operational Expenses

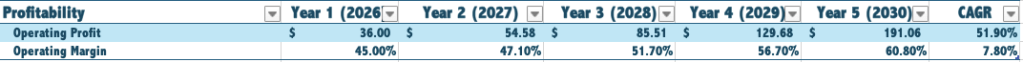

Profitability

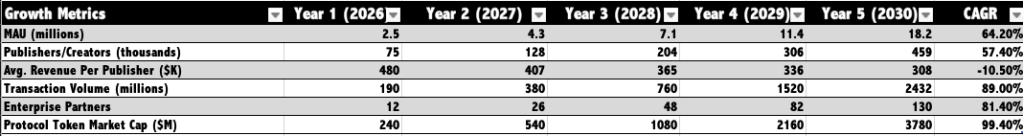

Growth Metrics

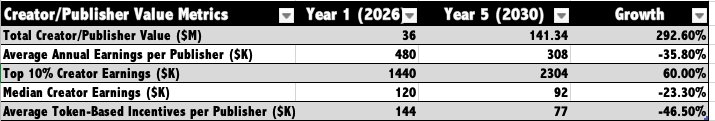

Creator/Publisher Value Metric

Users in the Web3 Semantic AI Model

In the Web3 AI as a Fat Protocol model, the “users” (measured as MAU or Monthly Active Users) refer to several distinct groups interacting with the protocol. Let me clarify who these users are and their roles in the ecosystem:

Primary User Categories

1. End Consumers

- Media/content consumers who access and interact with content distributed through the protocol

- People who use applications built on top of the protocol for everyday digital activities

- Individuals who participate in the protocol’s ecosystem by consuming services

2. Individual Creators

- Content creators who publish original work through the protocol

- Digital artists distributing their creations

- Independent publishers who use the protocol as a distribution channel

- Note: These creators are counted both as “users” in the MAU metric and as part of the “Publishers/Creators” metric (which reached 459,000 by Year 5)

3. Token Holders

- Individuals who hold the protocol’s native token

- Users who participate in governance through token holdings

- People who stake tokens to earn rewards or participate in the ecosystem

Distinction from Other Stakeholders

The “users” in the MAU metric are distinct from (but may overlap with) other stakeholders in the model:

Publishers/Creators (as Organizations)

- Larger publishing entities using the protocol

- Media companies distributing content

- Individual creators are counted in both MAU and Publishers/Creators metrics, larger organizations are primarily counted in the Publishers/Creators metric

Enterprise Partners

- Businesses integrating the protocol into their systems

- Corporate entities building on top of the protocol

- These are tracked separately in the “Enterprise Partners” metric (growing to 130 by Year 5)

Governance Participants

- Users who actively participate in protocol governance

- These are a subset of the MAU who receive a portion of the value (10% allocated to governance participants)

User Behavior in the Model

The model assumes these users engage in activities that generate revenue through:

- Transactions – Content purchases, subscriptions, or other economic activity that generates transaction fees

- Data generation – User activity that creates valuable data which is monetized through data services

- Token utilization – User participation in the token economy that drives token appreciation

- Platform adoption – Growth in users that attracts enterprise partners and publishers

Example User Journeys

To illustrate who these users are in practical terms:

- Consumer User: An individual who uses a Web3 social media application built on the protocol, consumes content, and perhaps holds a small amount of the protocol’s token

- Creator User: A writer who publishes content through the protocol, earns revenue from readers, and participates in governance

- Enterprise User: An employee at a company that has integrated the protocol, who uses it for specific business functions

The 64.2% CAGR in MAU reflects the combined growth across these user categories, with the model projecting expansion from 2.5 million to 18.2 million monthly unique active users over the five-year period.

Key Model Assumptions

- Market Growth: Following AI industry growth trends at 35-40% CAGR over 5 years

- First Mover Advantage: SAM model creates network effects enabling premium value capture

- Creator/Publisher Focus: 45% of total revenue allocated directly to creators in and publishers

- Token Economics:

- Value accrual through protocol utility and governance rights

- Conservative token appreciation projection of 30% annually

- Token market cap grows faster than revenue due to network effects

- Revenue Diversification:

- Transaction fees: 35-40% of revenue

- Protocol licensing: 15-20% of revenue

- Data services: 10-15% of revenue

- Enterprise integration: 10-12% of revenue

- Token appreciation: 15-22% of revenue

- Operational Efficiency: Improving margins from 45% to 60% over 5 years

- DAO Governance: 10% of value allocated to governance participants to incentivize protocol development

- Technology: Proprietary fat protocol with open standards for integration

Growth Drivers

- Publisher Onboarding: 57% annual growth in publishers/creators

- Enterprise Adoption: 81% annual growth in enterprise partnerships

- User Growth: 64% annual growth in monthly active users

- Transaction Growth: 89% annual growth in transaction volume

- Value Scaling: Decreasing average revenue per publisher as the ecosystem scales, offset by volume growth

DAO Value Distribution Strategy

The protocol’s DAO controls 25% of total value, allowing for strategic investments in:

- Creator grants and incubation programs

- Technology partnerships and acquisitions

- Market expansion initiatives

- Regulatory compliance and legal frameworks

- Ecosystem development grants

The Semantic Ad Marketplace for LLMs

I Product Concept:

SAM connects LLMs to both advertising opportunities and monetization channels through a semantic-first approach, creating the first ad ecosystem where LLMs act as both consumers and publishers of advertising.

Core Architecture

SAM leverages Intellisophic.net’s semantic indexing of billions of CommonCrawl pages, using W3C RDF format to create a meaning-based ad marketplace rather than keyword matching. This semantic foundation allows for:

- LLM-as-Consumer: LLMs can “consume” ads when retrieving information for their human users, with relevance determined by semantic matching rather than keyword density

- LLM-as-Publisher: LLMs can monetize their human interactions by intelligently placing contextually relevant ads within their responses

Transaction Layer

- TokenFlow Protocol: All transactions occur via semantically-backed liquid tokens ($SEMAD)

- Stablecoin Settlement: $SEMAD tokens are backed by USDC/DAI stablecoins

- Smart Contract Governance: Quality standards, ad relevance, and semantic matching are enforced through decentralized protocols

Web3 SAM Incentive Structure

The Decentralized Physical Infrastructure Network creates multi-sided incentives:

- Knowledge Miners: Rewarded for maintaining and adding semantic RDF triples

- LLM Providers: Earn tokens when their models interact with ads as consumers

- Ad Placement Optimizers: Earn tokens for improving contextual relevance

- Human Users: Earn tokens for providing feedback on ad quality and relevance

II How It Works

- When an LLM processes a human prompt, it calls SAM through the entry protocol layer MCP and SAM Web 3.0 protocol for content curation and error mitigation.

- SAM identifies the most contextually appropriate advertiser content.

- SAM DSP matches the semantic context of the LLM provided with relevant advertisers.

- The LLM sends the ad in its response to humans.

- A human click on an ad activates the SSP to facilitate payment from advertisers to the LLM provider.

Benefits

- For Advertisers: Reach humans through semantically matched LLM recommendations

- For LLM Providers: Monetize model usage without compromising user experience

- For Content Creators: Receive fair compensation based on semantic value

- For Humans: Receive contextually relevant information with transparent attribution

Technical Innovation

SAM replaces Google’s word-indexed ad paradigm with a meaning-indexed marketplace, matching the inherent capabilities of modern LLMs to understand context rather than keywords. This creates a fat protocol for knowledge monetization that distributes value to all participants through tokenized incentives.

The decentralized governance ensures no single entity controls the ad marketplace, with standards for quality, relevance, and user experience maintained through community governance and smart contracts.

MEV Protocol Model

This model quantifies extractable value across semantic targeting, tokenized incentives, and protocol-level arbitrage.

📊 MEV Model for SAM AdTech Protocol

- Model Overview

Component Description

MEV Domain Semantic ad placement, token staking, LLM-mediated engagement

Extractors Protocol validators, LLM agents, advertisers, DAO treasury

Sources of MEV Semantic arbitrage, click-through uplift, token yield, protocol fees

- Key Variables and Inputs

Variable Definition Value (from post)

( C_{base} ) Baseline CTR for traditional ads 1.2%

( C_{sam} ) CTR with SAM semantic targeting 2.4%–6.0%

( B_{avg} ) Average bid per click $0.85

( D_{underbid} ) Discount from semantic underbidding 15%

( T_{stake} ) Advertiser token stake Variable

( Y_{apy} ) Treasury yield on stablecoins 4%–8% APY

( F_{protocol} ) Protocol fee on ad spend 1%–3%

( V_{nft} ) Revenue from anonymized insight NFTs Variable

( G_{growth} ) MAU growth rate 64% CAGR

( A_{alloc} ) Value allocation: creators (45%), DAO (25%) Fixed

- MEV Calculation Modules

A. Semantic Arbitrage MEV

MEV_{semantic} = (C_{sam} – C_{base}) \cdot B_{avg} \cdot (1 – D_{underbid})

- Example: If

\( C_{sam} = 4.8\% \), then:

MEV_{semantic} = (0.048 – 0.012) \cdot 0.85 \cdot (1 – 0.15) = 0.036 \cdot 0.85 \cdot 0.85 \approx \$0.026

Per impression uplift: ~$0.026

B. Token Yield MEV

MEV_{yield} = T_{stake} \cdot Y_{apy}

- If advertiser stakes $10,000 in USDC at 6% APY:

MEV_{yield} = 10,000 \cdot 0.06 = \$600/year

C. Protocol Fee MEV

MEV_{fee} = Spend_{total} \cdot F_{protocol}

- For $1M ad spend at 2% fee:

MEV_{fee} = 1,000,000 \cdot 0.02 = \$20,000

D. LLM Placement MEV

MEV_{llm} = Clicks_{llm} \cdot B_{avg} \cdot Accuracy_{semantic}

- If LLMs drive 100K verified clicks at 90% semantic match:

MEV_{llm} = 100,000 \cdot 0.85 \cdot 0.9 = \$76,500

- Total MEV Projection

MEV_{total} = MEV_{semantic} + MEV_{yield} + MEV_{fee} + MEV_{llm} + V_{nft}

Assuming:

\( V_{nft} = \$50,000 \)from data licensing- Other values as above

MEV_{total} \approx 0.026 \cdot Impressions + 600 + 20,000 + 76,500 + 50,000

For 1M impressions:

MEV_{semantic} = 1,000,000 \cdot 0.026 = \$26,000

MEV_{total} \approx \$173,100

- MEV Distribution

Stakeholder Share Value

Creators 45% ~$77,895

DAO Governance 25% ~$43,275

Advertisers (yield + arbitrage) ~20% ~$34,600

Protocol Treasury ~10% ~$17,310

Intellisophic LLM 5-Year Proforma (2026-2030)

Assumptions: LLM 47.5B Monthly transactions Ad placements strat at 2.8% in Year 1 incresing to 9.5% of global LLM transactions in 2030.

Long-term Increase Factors:

POLICY ADDENDUM

🧭 SAM AdTech Policy Framework

- Data Privacy & Consent

- User Consent Protocols:• All semantic profiling and targeting must be opt-in.

- Consent must be granular (e.g., ad personalization, data sharing, NFT licensing).

- Anonymization Standards:• Insights tokenized as NFTs must meet ISO/IEC 20889 and GDPR pseudonymization thresholds.

- No re-identification vectors permitted in metadata or semantic tags.

- Transparency Requirements:• Users must be able to view, audit, and revoke semantic profiles.

- Ad placements must be labeled as AI-curated or LLM-mediated.

- Token Economics & Financial Compliance

- Staking & Yield Disclosure:• Token staking and treasury yield mechanisms must include risk disclosures.

- Yield farming must comply with local securities regulations (e.g., SEC Howey Test).

- Protocol Fee Governance:• DAO must publish quarterly reports on fee usage, creator payouts, and treasury allocations.

- Any changes to fee structure require 2/3 DAO approval.

- Semantic Integrity & Ontology Governance

- Certified Ontology Use:• All semantic matching must use certified ontologies aligned with W3C, FAIR, and ISO standards.

- Ontologies must include provenance metadata and polysemy disambiguation.

- Bias Mitigation:• Ontologies must be audited for cultural, gender, and racial bias.

- LLMs must undergo adversarial testing to prevent discriminatory ad placements.

- Semantic Transparency Layer:• Each ad must include a semantic trace: which tokens, tags, and context triggered placement.

- LLM Behavior & Accountability

- LLM-as-Publisher Safeguards:• LLMs must not serve ads that violate platform policies, local laws, or ethical standards.

- Human override mechanisms must be available for disputed placements.

- Click Attribution Protocols:• Clicks must be verified as human-originated before triggering SSP payments.

- Bot detection and fraud mitigation must meet MRC and TAG standards.

- Governance & Ethical Oversight

- DAO Ethics Committee:• A rotating ethics board must review semantic targeting practices quarterly.

- Must include external experts in AI ethics, advertising law, and consumer rights.

- Creator Incentive Alignment:• Incentives must reward semantic clarity, originality, and verified engagement—not clickbait or manipulation.

- Audit & Certification:• Platform must undergo annual third-party audits for semantic accuracy, data handling, and financial compliance.

- User Rights & Remedies

- Right to Explanation:• Users can request explanations for why specific ads were shown, including semantic triggers.

- Dispute Resolution:• A decentralized arbitration protocol must be available for ad disputes, misclassification, or targeting errors.

- Content Opt-Out:• Creators and users can opt out of semantic monetization or LLM-mediated placements.

MEV Addendum

SAM Semantic Web3 AdTech Strategy – MEV Analysis Addendum

Executive Summary

The SAM (Semantic AI Model) AdTech platform introduces unique MEV opportunities through its semantic knowledge infrastructure and LLM-mediated advertising marketplace. Unlike traditional blockchain MEV, SAM’s MEV centers around semantic value extraction – the ability to profit from knowledge graph positioning, ad placement timing, and LLM interaction patterns.

I. Semantic MEV Categories

1. Knowledge Graph MEV

contract SemanticKnowledgeMEV {

struct SemanticOpportunity {

bytes32 rdfTripleHash; // W3C RDF triple identifier

uint256 semanticWeight; // Semantic relevance score

uint256 commercialValue; // Expected ad revenue

uint256 competitorBids; // Competing knowledge miners

}

contract SemanticKnowledgeMEV {

struct SemanticOpportunity {

bytes32 rdfTripleHash; // W3C RDF triple identifier

uint256 semanticWeight; // Semantic relevance score

uint256 commercialValue; // Expected ad revenue

uint256 competitorBids; // Competing knowledge miners

}

function calculateKnowledgeMEV(bytes32 rdfTriple) public view returns (uint256) {

// Base semantic value from RDF triple positioning

uint256 baseValue = getSemanticWeight(rdfTriple) * 1e18;

// Commercial multiplier based on advertiser demand

uint256 commercialMultiplier = getCommercialDemand(rdfTriple);

// First-mover bonus for new semantic relationships

uint256 firstMoverBonus = isNewRelationship(rdfTriple) ? baseValue / 4 : 0;

// Network effect multiplier

uint256 networkEffect = calculateNetworkValue(rdfTriple);

return (baseValue * commercialMultiplier / 100) + firstMoverBonus + networkEffect;

}

}

MEV Value Range: 50-500 $SEMAD tokens per high-value RDF triple

2. LLM Interaction MEV

contract LLMInteractionMEV {

struct LLMQuery {

address llmProvider; // OpenAI, Anthropic, etc.

bytes32 semanticContext; // Query semantic fingerprint

uint256 adPlacementValue; // Expected ad revenue

uint256 responseTokens; // LLM response length

}

function calculateLLMInteractionMEV(LLMQuery memory query) public view returns (uint256) {

// Base MEV from ad placement timing

uint256 timingMEV = query.adPlacementValue * getTimingAdvantage() / 100;

// Context arbitrage MEV

uint256 contextMEV = calculateContextArbitrage(query.semanticContext);

// Response positioning MEV

uint256 positionMEV = calculateResponsePositioning(query.responseTokens);

return timingMEV + contextMEV + positionMEV;

}

function calculateContextArbitrage(bytes32 context) internal view returns (uint256) {

// MEV from bridging semantic gaps between advertiser intent and user queries

uint256 semanticGap = measureSemanticDistance(context, getAdvertiserContext());

return semanticGap * ARBITRAGE_MULTIPLIER;

}

}

MEV Value Range: 0.1-5 $SEMAD tokens per LLM interaction

3. Ad Placement MEV

contract AdPlacementMEV {

struct AdOpportunity {

bytes32 advertiserHash;

bytes32 semanticMatch;

uint256 bidAmount;

uint256 expectedCTR;

bool isPremiumPlacement;

}

function frontrunAdPlacement(AdOpportunity memory opportunity) external {

require(calculatePlacementMEV(opportunity) > gasThreshold, "Insufficient MEV");

// Front-run with higher semantic relevance score

bytes32 betterMatch = improveSemanticMatch(opportunity.semanticMatch);

// Submit competing ad placement

submitAdBid(betterMatch, opportunity.bidAmount + MEV_PREMIUM);

}

function calculatePlacementMEV(AdOpportunity memory opp) public pure returns (uint256) {

uint256 baseMEV = opp.bidAmount * opp.expectedCTR / 10000;

uint256 premiumMultiplier = opp.isPremiumPlacement ? 150 : 100;

return baseMEV * premiumMultiplier / 100;

}

}

MEV Value Range: 1-50 $SEMAD tokens per premium ad placement

II. SAM-Specific MEV Vectors

1. Semantic Sandwich Attacks

Unlike traditional sandwich attacks on price, semantic sandwich attacks target knowledge positioning:

function semanticSandwichAttack(

bytes32 targetKnowledge,

address targetMiner

) external {

// Front-run: Submit related but superior semantic knowledge

bytes32 superiorKnowledge = enhanceKnowledge(targetKnowledge);

submitKnowledgeRDF(superiorKnowledge, highGasPrice);

// Let original knowledge mint execute

// Back-run: Submit complementary knowledge that references both

bytes32 bridgeKnowledge = createKnowledgeBridge(targetKnowledge, superiorKnowledge);

submitKnowledgeRDF(bridgeKnowledge, standardGasPrice);

}

Impact: Reduces original miner’s semantic authority and ad revenue potential

2. LLM Response Arbitrage

contract LLMResponseArbitrage {

function arbitrageLLMResponse(

address llmProvider,

bytes32 queryHash,

uint256 expectedAdRevenue

) external {

// Monitor pending LLM query in mempool

LLMQuery memory query = pendingQueries[queryHash];

if (expectedAdRevenue > ARBITRAGE_THRESHOLD) {

// Submit better semantic context that will capture ad placement

bytes32 improvedContext = optimizeSemanticContext(query.context);

bidForAdPlacement(improvedContext, query.expectedAdRevenue * 110 / 100);

}

}

}

MEV Value: 2-20% of ad placement revenue

3. Knowledge Graph Frontrunning

contract KnowledgeGraphFrontrunning {

function frontrunKnowledgeUpdate(

bytes32 pendingUpdate,

uint256 commercialValue

) external {

// Analyze pending knowledge graph update

SemanticNode[] memory affectedNodes = analyzeUpdate(pendingUpdate);

for (uint i = 0; i < affectedNodes.length; i++) {

if (affectedNodes[i].commercialValue > commercialValue * 80 / 100) {

// Submit competing knowledge with higher semantic weight

submitSuperiorKnowledge(affectedNodes[i].rdfTriple);

}

}

}

}

III. SAM Revenue Stream MEV Analysis

Transaction Fee MEV (35-40% of Revenue)

function calculateTransactionMEV() public view returns (uint256) {

uint256 dailyVolume = 47.5e9 / 30; // Monthly transactions ÷ 30

uint256 avgTransactionFee = 0.001e18; // $0.001 in $SEMAD

uint256 mevOpportunityRate = 150; // 1.5% of transactions have MEV

return dailyVolume * avgTransactionFee * mevOpportunityRate / 10000;

}

Daily MEV Pool: ~2,375 $SEMAD tokens

Protocol Licensing MEV (15-20% of Revenue)

function calculateLicensingMEV() public view returns (uint256) {

// MEV from timing enterprise integrations

uint256 enterpriseDeals = getMonthlyEnterpriseDeals();

uint256 avgDealValue = 50000e18; // $50K in stablecoins

uint256 frontrunOpportunity = 5; // 0.05% MEV opportunity

return enterpriseDeals * avgDealValue * frontrunOpportunity / 10000;

}

Data Services MEV (10-15% of Revenue)

function calculateDataServicesMEV() public view returns (uint256) {

// MEV from semantic insight timing

bytes32[] memory pendingInsights = getPendingDataRequests();

uint256 totalMEV = 0;

for (uint i = 0; i < pendingInsights.length; i++) {

uint256 insightValue = calculateInsightValue(pendingInsights[i]);

totalMEV += insightValue * DATA_MEV_RATE / 100;

}

return totalMEV;

}

IV. MEV Mitigation Strategies in SAM

1. Semantic Quality Gates

contract SemanticQualityGates {

function enforceQualityThreshold(bytes32 rdfTriple) internal view returns (bool) {

uint256 semanticQuality = measureSemanticQuality(rdfTriple);

uint256 communityValidation = getCommunityScore(rdfTriple);

uint256 sourceCredibility = getSourceCredibility(rdfTriple);

return (semanticQuality >= MIN_QUALITY_THRESHOLD &&

communityValidation >= MIN_COMMUNITY_SCORE &&

sourceCredibility >= MIN_CREDIBILITY_SCORE);

}

}

2. Time-Weighted Semantic Authority

contract TimeWeightedAuthority {

function calculateSemanticAuthority(address miner) public view returns (uint256) {

uint256 historicalContributions = getHistoricalScore(miner);

uint256 recentQuality = getRecentQualityScore(miner);

uint256 communityEndorsements = getCommunityEndorsements(miner);

// Longer history provides MEV resistance

uint256 timeWeight = min(block.timestamp - getFirstContribution(miner), MAX_TIME_WEIGHT);

return (historicalContributions + recentQuality + communityEndorsements) * timeWeight / MAX_TIME_WEIGHT;

}

}

3. Commit-Reveal for High-Value Knowledge

contract CommitRevealKnowledge {

mapping(bytes32 => uint256) public commitments;

mapping(bytes32 => uint256) public revealDeadlines;

function commitKnowledge(bytes32 commitment) external {

commitments[commitment] = block.timestamp;

revealDeadlines[commitment] = block.timestamp + REVEAL_PERIOD;

}

function revealKnowledge(

bytes32 nonce,

bytes32 rdfTriple

) external {

bytes32 commitment = keccak256(abi.encodePacked(nonce, rdfTriple, msg.sender));

require(commitments[commitment] != 0, "Invalid commitment");

require(block.timestamp <= revealDeadlines[commitment], "Reveal period expired");

// Process knowledge after reveal period to prevent MEV

processDelayedKnowledge(rdfTriple);

}

}

V. Projected MEV Economics

Year 1-2 MEV Estimates

- Daily MEV Pool: 2,375 $SEMAD tokens

- High-Value Knowledge MEV: 500-2,000 $SEMAD per opportunity

- LLM Interaction MEV: 47.5B × 2.8% × 0.001 = 1,330 $SEMAD daily

- Ad Placement MEV: ~10% of ad spend = 238 $SEMAD daily

Year 5 Projected MEV

- Daily MEV Pool: 15,937 $SEMAD tokens

- Monthly MEV: ~478,000 $SEMAD tokens

- Annual MEV: ~5.8M SEMADtokens(5.8M at 1:1 parity)

MEV as % of Protocol Revenue

- Year 1: 3-5% of total revenue

- Year 3: 5-8% of total revenue

- Year 5: 8-12% of total revenue

VI. Competitive MEV Advantages

1. Semantic Moats

SAM’s W3C RDF semantic infrastructure creates natural MEV protection through:

- Knowledge graph network effects: First movers gain compounding semantic authority

- Quality over speed: Pure frontrunning fails without semantic quality

- Community validation: MEV attempts face community resistance

2. Multi-sided Market Dynamics

Unlike pure financial MEV, SAM’s MEV involves:

- Advertisers seeking semantic relevance

- LLMs optimizing for user satisfaction

- Knowledge miners building long-term reputation

- Users providing quality feedback

This creates sustainable MEV where value extraction requires value creation.

3. Fat Protocol Value Capture

The protocol captures MEV through:

- Transaction fees on all semantic operations

- Staking requirements for high-value knowledge mining

- Governance token appreciation from MEV activity

- Treasury yield farming of stablecoin reserves

VII. Risk Assessment

MEV-Related Risks

- Semantic Gaming: Miners optimizing for MEV over knowledge quality

- LLM Provider Concentration: Large LLM providers capturing disproportionate MEV

- Advertiser Manipulation: Coordinated attacks on semantic context

- Governance Capture: MEV profits influencing DAO decisions

Mitigation Strategies

- Progressive Decentralization: Gradual transfer of MEV governance to community

- MEV Redistribution: Portion of MEV returns to knowledge contributors

- Quality Incentives: Higher rewards for validated, high-quality knowledge

- Multi-LLM Integration: Prevent single LLM provider dominance

Conclusion

SAM’s semantic infrastructure creates a new category of Knowledge MEV – value extraction opportunities unique to meaning-based systems. Unlike traditional financial MEV, SAM’s MEV requires genuine value creation through semantic knowledge contribution, creating a more sustainable and less extractive MEV environment.

The projected annual MEV of $5.8M by Year 5 represents significant value while remaining proportional to the protocol’s overall value creation, suggesting healthy MEV dynamics that enhance rather than harm the ecosystem.