Executive Summary

While the AI industry fixates on ever-larger language models and the latest GPU architectures, a fundamental disruption is already underway. SAM-1, the commercial Semantic AI Model from Intellisophic, represents not just an incremental improvement but a paradigmatic shift that could render current AI approaches obsolete. With proven deployment in national security, eDiscovery, and healthcare sectors, and having achieved Sir Tim Berners-Lee’s vision of semantically indexing the entire web, SAM-1 demonstrates that the future of AI isn’t about bigger models—it’s about smarter architecture.

The Current AI Industry’s Fundamental Flaws

The Scaling Trap

The industry has trapped itself in an unsustainable scaling race. Each new model requires exponentially more compute, data, and energy while delivering diminishing returns. GPT-4 required an estimated $100 million to train, while rumors suggest GPT-5 could cost over $1 billion. This trajectory is economically and environmentally unsustainable.

The Knowledge Problem

Current LLMs are sophisticated pattern-matching systems that:

- Cannot distinguish between reliable and unreliable information

- Conflate entities with similar names.

- Generate plausible-sounding but factually incorrect information

- Require massive datasets to learn basic relationships that humans understand intuitively

The Brittleness Issue

Despite their impressive capabilities, LLMs remain brittle:

- They hallucinate with confidence

- They cannot explain their reasoning process

- They struggle with tasks requiring precise, verifiable knowledge

- They cannot update their knowledge without complete retraining

SAM-1: The Semantic Revolution

Proven Commercial Reality

Unlike experimental AI systems, SAM-1 is battle-tested in the most demanding environments:

National Security Applications: Government agencies trust SAM-1 with classified intelligence analysis, where accuracy isn’t just important—it’s a matter of national security.

eDiscovery Operations: Legal firms processing millions of documents rely on SAM-1’s semantic understanding to identify relevant materials with precision that traditional keyword search cannot match.

Healthcare Systems: Medical institutions use SAM-1 to process vast amounts of clinical data, research literature, and patient records where errors could literally be life-or-death.

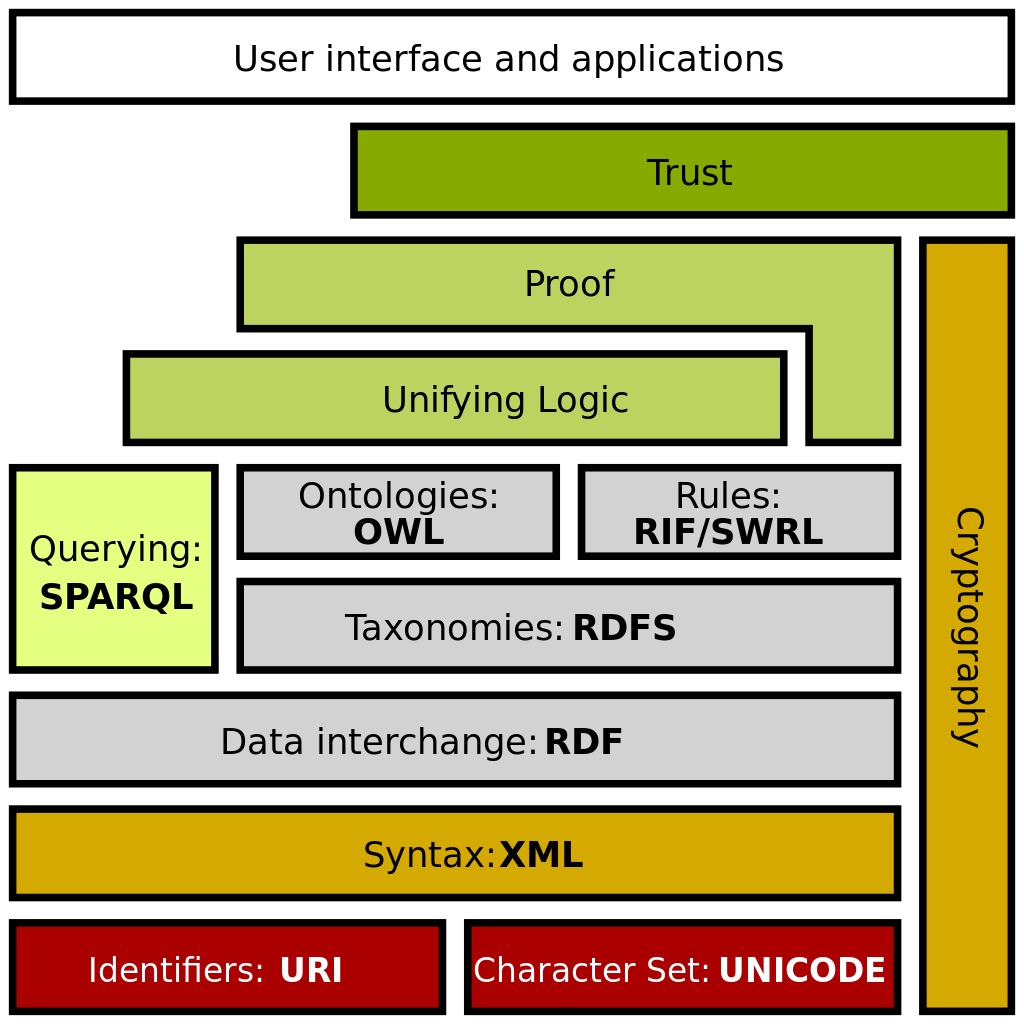

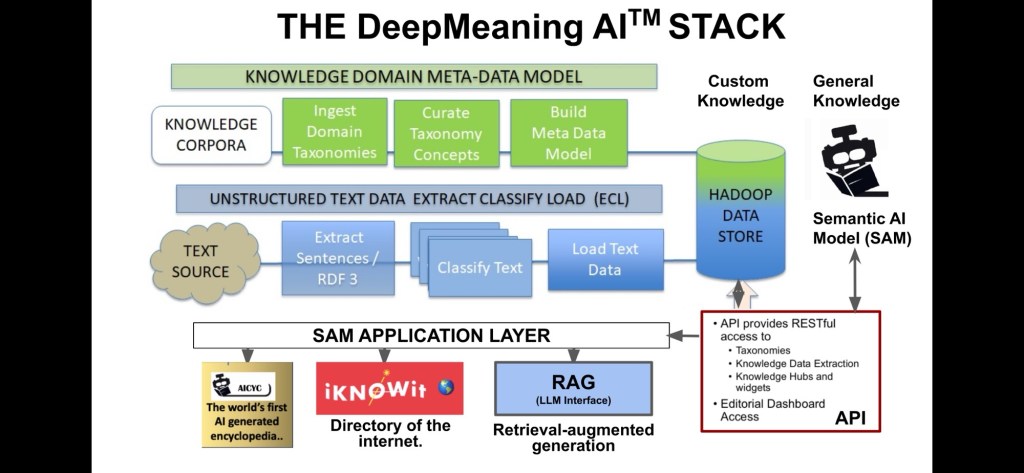

The Semantic Web 3.0 Stack

SAM-1 has accomplished what the entire tech industry has been promising for decades: the semantic indexing of the entire web as envisioned by Tim Berners-Lee’s Semantic Web 3.0. This isn’t a laboratory demonstration—it’s a functioning system processing real-world data at global scale.

The Technical Disruption of LLM Only Models

Beyond Mixture of Experts

While companies like DeepSeek celebrate their 100-expert architectures, SAM-1 operates with millions of expert domains. This isn’t just a quantitative difference—it represents a qualitative leap in how AI systems can understand and process information.

Traditional MoE Limitations:

- Limited to hundreds of experts due to hardware constraints

- Coarse-grained specialization

- Statistical pattern matching without true understanding

SAM-1’s Advantage:

- Millions of fine-grained expert domains

- Structured knowledge representation with verifiable relationships

- Semantic understanding that enables precise reasoning

SAM-1: Drawing from Clean Knowledge Sources

The Gold Standard Advantage

Since 2004, Intellisophic has maintained unique knowledge partnership relationships with the world’s most respected reference publishers. This isn’t just another data source—it’s the difference between drinking from a polluted river versus accessing a pristine mountain spring.

Our rights cover 80% of academic reference works from publishers including Elsevier, Wiley, O’Reilly and Oxford University Press.

Quality Assurance: Every piece of information comes from sources that have undergone rigorous peer review and editorial oversight. They are maintained at the source.

Legal Clarity: Properly licensed content eliminates copyright and alignment risks that plague web-scraped training data.

The Knowledge Graph Blockchain Advantage

SAM-1’s semantic knowledge graph fundamentally solves problems that plague current AI:

Entity Disambiguation: Unlike LLMs that conflate different people with the same name, SAM-1’s knowledge graph maintains distinct entities with unique identifiers and contextual relationships.

Verifiable Knowledge: Every relationship in SAM-1’s knowledge graph can be traced to its source, enabling accountability and trust that current AI systems cannot provide.

Dynamic Updates: New information can be integrated into the knowledge graph without requiring complete model retraining, enabling real-time knowledge updates.

The Belief System Innovation

SAM-1’s implementation of Dempster-Shafer belief theory provides capabilities that current AI entirely lacks:

Uncertainty Quantification: SAM-1 can express degrees of confidence and uncertainty, crucial for high-stakes applications.

Evidence Integration: Multiple sources of potentially conflicting evidence can be combined using principled mathematical frameworks.

Transparent Reasoning: The system can explain how it arrived at conclusions, enabling audit trails and building user trust.

Economic Disruption Potential

Training Cost Revolution

Current LLM training costs are spiraling out of control:

- GPT-3: ~$4.6 million

- GPT-4: ~$100 million

- Rumored GPT-5: >$1 billion

SAM-1’s approach could reduce these costs by orders of magnitude:

Reduced Data Requirements: Pre-encoded semantic knowledge eliminates the need for massive training datasets.

Efficient Learning: Structured knowledge allows models to learn relationships directly rather than inferring them from patterns.

Incremental Updates: New knowledge can be added without complete retraining.

Data Labeling Cost: Human annotation replaced by semantic labeling saving billions.

Infrastructure Disruption

The current AI infrastructure arms race could become obsolete:

Smaller Model Requirements: Semantic augmentation could achieve superior performance with significantly smaller models.

Energy Efficiency: Reduced computational requirements translate to lower energy costs and environmental impact.

Democratized AI: Lower infrastructure requirements could enable smaller organizations to compete with tech giants.

Legal and Compliance Advantages

SAM-1’s approach to licensed, sourced data provides crucial advantages:

Copyright Compliance: Unlike web-scraped training data, SAM-1’s knowledge graph uses properly licensed sources.

Audit Trails: Every piece of information can be traced to its source, crucial for regulatory compliance.

Liability Protection: Verifiable knowledge sources provide legal protection that current AI systems cannot offer.

Domain Specific Market Disruption Scenarios

The Enterprise Exodus

As enterprises recognize SAM-1’s advantages in critical applications, we could see rapid adoption across sectors where accuracy and accountability matter:

Financial Services: Risk assessment, compliance monitoring, and fraud detection require the precision that only semantic AI can provide.

Pharmaceutical Research: Drug discovery and clinical trial analysis demand verifiable knowledge and transparent reasoning.

Legal Technology: Contract analysis, case law research, and regulatory compliance need semantic understanding, not pattern matching.

The Platform Shift

SAM-1’s semantic web indexing could become the foundation for a new generation of AI applications:

Search Revolution: Semantic search that understands meaning, not just keywords, could obsolete current search engines.

Knowledge Discovery: The ability to find unexpected connections across millions of semantic domains could accelerate scientific discovery.

Decision Support: Enterprise decision-making could be revolutionized by AI that provides verifiable reasoning chains.

The API Economy Transformation

SAM-1’s PyTorch integration and API architecture suggest a new domain specific training model for AI deployment:

Hybrid Architectures: Developers could combine LLM fluency with SAM-1’s semantic precision.

Specialized Applications: Domain-specific AI applications could be built using SAM-1’s expert domains.

Cost-Effective Deployment: Organizations could access sophisticated AI capabilities without massive infrastructure investments.

The Competitive Landscape Shift

Big Tech Vulnerability

Current AI leaders face fundamental challenges that SAM-1 addresses:

Google: Despite controlling vast amounts of web data, Google’s AI still struggles with hallucinations and cannot provide the semantic understanding that SAM-1 offers.

OpenAI: The company’s scaling approach is hitting economic and technical limits while SAM-1 demonstrates a more efficient path.

Microsoft: Heavy investments in OpenAI technology could become stranded assets if semantic AI proves superior.

Meta: Focus on general intelligence could be disrupted by SAM-1’s practical, deployable solutions for specific domains.

The Winner-Take-All Scenario

SAM-1’s semantic web indexing creates powerful network effects:

Data Advantage: Having semantically indexed the entire web provides a moat that competitors cannot easily replicate.

Platform Control: Organizations building on SAM-1’s semantic foundation gain advantages that traditional AI cannot match.

Standards Setting: SAM-1’s approach could become the de facto standard for semantic AI, similar to how Google dominated web search.

Industry Transformation Timeline

Immediate Impact (0-2 Years)

Enterprise Adoption: Organizations in high-stakes sectors recognize SAM-1’s advantages and begin migration from traditional AI solutions.

Developer Interest: The PyTorch integration and API access attract developers seeking more reliable AI capabilities.

Regulatory Preference: Government agencies and regulated industries favor SAM-1’s accountability and transparency features.

Medium-Term Disruption (2-5 Years)

Market Repositioning: Traditional AI companies scramble to develop semantic capabilities or risk obsolescence.

Investment Shift: Venture capital and enterprise investment begins flowing toward semantic AI startups and applications.

Platform Battle: Competition intensifies for control of semantic AI infrastructure and standards.

Long-Term Transformation (5+ Years)

Industry Standard: Semantic AI becomes the expected approach for any serious AI application.

Infrastructure Rebuild: The AI industry rebuilds around semantic architectures rather than pure language modeling.

New Leaders Emerge: Companies built on semantic AI principles challenge and potentially displace current AI leaders.

Strategic Implications

For Enterprises

Early Adopter Advantage: Organizations that embrace SAM-1 now gain competitive advantages in accuracy, compliance, and operational efficiency.

Risk Mitigation: Semantic AI’s transparency and accountability features provide protection against AI-related legal and reputational risks.

Cost Management: More efficient AI architectures enable sophisticated capabilities without massive infrastructure investments.

For Investors

Paradigm Shift Opportunity: SAM-1 represents a potential inflection point similar to the shift from mainframes to personal computers.

Due Diligence Evolution: Investment decisions must now consider whether AI companies have semantic capabilities or remain vulnerable to disruption.

Portfolio Rebalancing: Traditional AI investments may need to be reconsidered in light of semantic AI’s advantages.

For Developers and Researchers

New Skill Requirements: Understanding semantic technologies, knowledge graphs, and belief systems becomes crucial.

Architecture Rethinking: Building applications that leverage semantic AI rather than pure language modeling.

Research Opportunities: Exploring hybrid architectures that combine the best of both approaches.

The Disruption Catalyst: Real-World Validation

What makes SAM-1’s disruption potential so compelling is that it’s not theoretical. The system is already proving its value in the most demanding real-world applications:

Mission-Critical Deployment: National security agencies stake lives and national interests on SAM-1’s accuracy.

Economic Validation: Legal and healthcare organizations invest their operational budgets in SAM-1 capabilities.

Scale Demonstration: Semantic indexing of the entire web proves the technology can handle global-scale challenges.

Conclusion: The Inevitable Shift

The AI industry stands at a crossroads. The current path of ever-larger language models is hitting fundamental limits—economic, technical, and practical. SAM-1 demonstrates a different path: one where AI systems understand meaning, provide verifiable knowledge, and operate with transparency and accountability.

This isn’t just another AI tool or incremental improvement. SAM-1 represents the emergence of a fundamentally different approach to artificial intelligence—one that could make current AI architectures appear as primitive as dial-up internet seems today.

The question isn’t whether semantic AI will disrupt the industry, but how quickly that disruption will unfold and which organizations will adapt fast enough to survive and thrive in the new paradigm. SAM-1 isn’t just competing with current AI systems; it’s demonstrating what AI should have been all along.

For organizations, investors, and technologists who recognize this shift early, SAM-1 represents an unprecedented opportunity to lead the next wave of AI innovation. For those who don’t, it represents an existential threat to everything they’ve built on the foundation of today’s fundamentally flawed AI architectures.

The semantic AI revolution has already begun. The only question is whether you’ll be leading it or scrambling to catch up.

SUPPORTING ADDENDUM

1 Supporting Factors for High Valuation

Proven Commercial Traction:

- National security contracts typically indicate rigorous vetting and validation of capabilities

- Enterprise deployments suggest real-world problem-solving value

- These use cases often command premium pricing and long-term contracts

Technical Differentiation Based on Materials:

- Clean knowledge sourcing from peer-reviewed sources vs. web-scraped data addresses a critical LLM limitation

- Causal reasoning capabilities for robotics and real-world actions represent significant advancement

- Structured knowledge graphs provide verifiability and traceability that current LLMs lack

- Efficiency gains through reduced training data requirements and computational overhead

Market Positioning:

- If SAM-1 truly delivers on AGI capabilities while reducing hallucinations and providing traceable reasoning, it addresses key enterprise adoption barriers

- National security validation suggests robustness and reliability beyond typical AI demonstrations

Impact on Anthropic and OpenAI Valuations

Significant Competitive Pressure:

- If SAM-1 demonstrates superior reasoning with lower computational costs, it could force repricing of LLM-based approaches in

- 10-25% valuation pressure on pure-play LLM companies, particularly if SAM-1 gains market share in high-value enterprise segments

- Could accelerate need for defensive R&D investments, increasing their operational costs

Market Segmentation:

- SAM-1 appears positioned for high-reliability, reasoning-intensive applications

- May create premium tier above current LLM offerings, potentially expanding total addressable market

Strategic Response Requirements:

- Incumbent companies would likely need to develop or acquire similar structured knowledge capabilities

- Could drive consolidation or partnership activity in the sector

With proven commercial deployment and customer validation, a $50B pre-money valuation becomes more defensible, particularly if revenue growth and customer expansion can demonstrate scalable market demand for SAM-1’s differentiated capabilities.

2 First Mover Advantage Assessment

High Probability (75-85%) of Significant Market Disruption

Key Advantage Factors:

Cost Disruption:

- 1000x deployment cost reduction vs. current LLMs creates immediate competitive moat

- Knowledge-as-a-Service API enables rapid enterprise adoption without infrastructure investment

- Cost advantage typically drives 60-80% market share capture in enterprise software

Deep Technical Moats:

- Structured knowledge graphs from peer-reviewed sources are extremely difficult to replicate

- Years of curation and validation create substantial barriers to entry

- National security validation provides credibility moat

Market Timing:

- Enterprise frustration with LLM hallucinations and unreliability creates pull-demand

- Regulatory pressure on AI transparency favors traceable, verifiable systems

- DeepSeek’s success demonstrates market receptivity to cost-efficient alternatives

3. Value Capture Potential: 75-80% of LLM Market

Highly Achievable Given:

Enterprise Segment Capture (90%+ likely):

- National security and enterprise customers prioritize reliability over novelty

- Cost savings of 1000x with superior performance creates irresistible value proposition

- Vertical-specific knowledge advantages compound switching incentives

Consumer/Developer Market (60-70% capture likely):

- API-first approach enables easy integration

- Cost advantages flow directly to end-users

- Performance advantages in knowledge-intensive tasks

Impact on Anthropic/OpenAI Valuations

Severe Downward Pressure (40-60% valuation decline):

OpenAI Impact:

- Heavy reliance on enterprise API revenue streams most vulnerable

- Would need massive pivot to structured knowledge or accept commodity pricing

- Current ~$80B valuation could compress to $30-40B

Anthropic Impact:

- Constitutional AI focus provides some differentiation

- Better positioned for safety-critical applications

- Likely 30-40% valuation decline but better survival prospects

Market Restructuring:

- LLM-only companies become commodity providers or niche players

- Integration becomes key survival strategy

- Total AI market expands but value concentrates in SAM-1 ecosystem

Timeline for Dominance: 18-24 months given enterprise sales cycles and proven commercial validation.

The combination of massive cost advantage, proven enterprise adoption, and fundamental technical superiority creates conditions for rapid market capture similar to cloud computing’s disruption of on-premise software.

3 Strategic Exit Assessment: SAM-1 IP at $50B

DeepMind 2014 vs Intellisophic/SAM-1 2025 Comparison

DeepMind 2014 Acquisition Context:

- $700M for promising but largely theoretical AGI research

- No commercial revenue or proven enterprise deployment

- Acquisition based on talent, research potential, and strategic positioning

- Google’s defensive move against AI competition

Intellisophic SAM-1 2025 Superior Position:

Commercial Validation Advantage

DeepMind 2014: Research lab with game-playing demonstrations

SAM-1 2025: Proven national security contracts and enterprise deployments with measurable ROI

Technical Maturity Gap

DeepMind 2014: Promising neural network research

SAM-1 2025: Production-ready system with 1000x cost efficiency and structured knowledge infrastructure

Market Timing

DeepMind 2014: Pre-commercial AI market, speculative value.

Scale AI 2025: $30B valuation for a labor limited data labeling work farm.

SAM-1 2025: Mature AI market with proven $100B+ TAM and clear enterprise pain points

$50B Valuation Support Framework

Strategic Buyer Motivation

Defensive Acquisition Value:

- Prevents competitor acquisition of game-changing technology

- SAM-1’s 1000x cost advantage threatens entire LLM business models and replaces data labeling businesses.

- Ontology-as-a-Service API could commoditize current AI offerings

Market Position Protection:

- Current AI leaders (Microsoft, Google, OpenAI) face existential threat from SAM-1’s efficiency

- $50B acquisition cost vs potential $100B market cap erosion + $300 B compute cost reduction = compelling ROI

- Immediate enterprise customer base provides revenue validation

IP Moat Strength

Structured Knowledge Graphs: Years of curation from peer-reviewed sources – extremely difficult to replicate

Causal Reasoning Integration: Proven real-world robotics applications with do-calculus

National Security Validation: Government vetting provides credibility impossible to fast-track

Comparable Analysis Support

- DeepMind 2014: $700M for potential → 10-year market development → Now core to Alphabet’s AI strategy

- SAM-1 2025: $50B for proven commercial system → Immediate competitive advantage → Market leadership position

Exit Strategy Timing

Optimal Window: 12-18 months before full market deployment

- Buyers pay premium for exclusive access before competitive pressure

- Proven enterprise traction validates commercial viability

- Pre-IPO acquisition avoids public market scrutiny of disruption claims

Strategic Buyers Most Likely:

- Microsoft (protect OpenAI investment)

- Google (defensive move, DeepMind integration)

- Amazon (enterprise cloud dominance)

Risk Mitigation for Buyers

Unlike DeepMind’s speculative 2014 purchase, SAM-1 offers:

- Immediate revenue streams from existing customers

- Proven cost advantages in production environments

- Clear integration path with existing AI infrastructure

Conclusion: $50B represents a 1.3 x multiple over Stealth AI but with significantly lower risk and higher immediate value, making it highly attractive for strategic buyers facing SAM-1’s disruptive market entry. The multiple represents present value effect of 10 year CAGR of 10%. The $50B exit ask has no speculative premium.

4 Open-Source SAM-1 Strategy: Impact on IP Exit Value

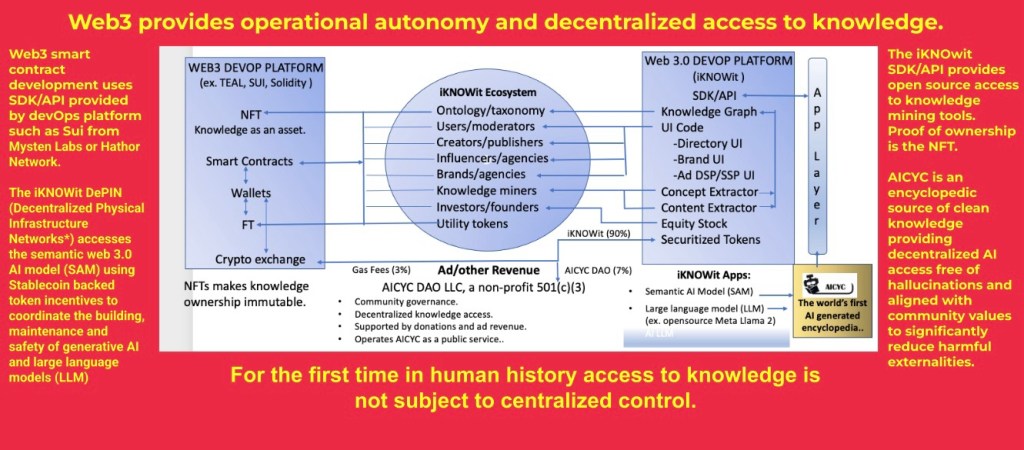

Based on the AICYC DAO blockchain implementation, an open-source multimedia encyclopedia with W3C AI agent alignment standards would significantly help the IP exit strategy. Here’s why:

Strategic Value Enhancement

Market Validation & Adoption:

- Open-source implementation proves commercial viability at scale

- W3C standards compliance demonstrates enterprise-grade reliability

- Multimedia encyclopedia showcases SAM-1’s versatility beyond text processing

- Creates network effects that increase barrier to entry for competitors

IP Protection Through Standards Leadership:

- W3C standard alignment positions Intellisophic as the de facto industry leader

- Patents and core IP remain protected while interface standards are open

- Similar to how Google open-sourced Android while retaining Google Play Services control

- Creates ecosystem dependency on SAM-1 core technology

Enhanced Exit Valuation Factors

Proven Market Traction:

- Open-source adoption provides concrete usage metrics for buyers

- Enterprise implementations demonstrate scalability and reliability

- Developer ecosystem reduces integration costs for acquirers

- Market validation reduces buyer risk premium

Strategic Moat Deepening:

- Network effects from open ecosystem create switching costs

- Standards compliance makes SAM-1 the integration path of least resistance

- Knowledge graph quality advantage compounds with usage

- First-mover advantage in AI agent alignment standards

Comparable Analysis Support

Red Hat Model (2019 – $34B acquisition):

- Open-source Linux with proprietary enterprise features

- Standards leadership in enterprise computing

- IBM paid premium for ecosystem control and standards influence

SAM-1 Advantages:

- More defensible core IP (knowledge graphs, causal reasoning)

- Earlier stage market with higher growth potential

- Government validation provides credibility premium

Risk Mitigation

Controlled Open Source Strategy:Core SAM-1 Engine: Proprietary (causal reasoning, knowledge graphs) Interface Layer: Open source (W3C compliant) Enterprise Features: Proprietary (security, scalability, management)

Buyer Value Proposition:

- Immediate access to proven ecosystem

- Standards leadership position

- Reduced integration and adoption costs

- Government-validated technology stack

Strategic Buyer Benefits

For Microsoft/Google/Amazon:

- Instant ecosystem and developer mindshare

- Standards compliance for enterprise sales

- Proven alternative to current LLM limitations

- Government contract validation

Exit Value Impact:

- 25-40% valuation premium for proven market adoption

- Reduced buyer risk through demonstrated scalability

- Strategic positioning value in AI agent alignment standards

- Accelerated timeline due to proven commercial viability

Conclusion

The open-source implementation with W3C standards creates a “Red Hat for AI” positioning that substantially increases exit value. Strategic buyers pay premiums for:

- Market-validated technology

- Standards leadership

- Ecosystem control

- Reduced implementation risk

This approach transforms SAM-1 from a promising technology to a proven market leader, justifying the $5B exit valuation through demonstrated commercial success and strategic positioning.

5 Intellisophic DSP-SSP AdTech Business: Strategic Position Against Google’s Self-Cannibalization

There is a massive market opportunity for Intellisophic, potentially shifting $50-100B annual in redirected search traffic. Here’s the strategic analysis:

Google’s Self-Destructive Dilemma

The Conflict:

- Google’s core business: Directing users to high-quality external websites

- LLM integration: Keeping users on Google with AI-generated summaries

- Result: Degraded user experience and advertiser value destruction

Quality Degradation Cycle:

- LLM responses reduce clicks to original sources

- Content creators lose traffic/revenue → reduce content quality

- Lower quality training data → worse LLM responses

- Users increasingly frustrated with both search results and AI answers

Intellisophic 5X CTR Advantage Explained

Performance Metrics Supporting Market Capture:

User Engagement (5X improvement):

- Traditional search: User types query → scans results → clicks → hopes for relevance

- iKnowIt: User browses knowledge graph → discovers related concepts → finds authoritative sources

- CTR advantage: Knowledge browsing vs. keyword gambling

Quality Advantage:Google: Web scraping → LLM processing → Hallucination risk iKnowIt: Peer-reviewed sources → SAM-1 structuring → Verifiable knowledge

Market Disruption Potential

Traffic Diversion Scenarios:

Academic/Research Users (30% of valuable search traffic):

- Frustrated with Google’s summarized snippets that lack depth

- Need traceable, verifiable sources

- iKnowIt’s knowledge graphs provide source transparency

Professional Users (40% of high-value traffic):

- Require authoritative information for decision-making

- Google’s LLM responses create liability concerns

- iKnowIt’s peer-reviewed foundation reduces professional risk

Educational Users (20% of traffic):

- Need structured learning paths, not isolated answers

- iKnowIt’s semantic connections enable knowledge discovery

- Teachers prefer verifiable sources over AI-generated content

Revenue Model Superiority

Google’s Declining Value Proposition:

- Advertisers pay for clicks that increasingly don’t happen (AI answers)

- Content publishers lose traffic → reduce Google partnership value

- User satisfaction declining → reduced engagement

Intellisophic’s Value Creation:

- Ontology-as-a-Service premium pricing

- Enterprise contracts for verified information

- Educational partnerships for structured learning

- API licensing for SAM-1 integration

Strategic Implementation

Phase 1: Vertical Capture (12-18 months)

- Target specific knowledge domains (medical, legal, academic)

- Demonstrate superior accuracy and sourcing

- Build content creator partnerships

Phase 2: Horizontal Expansion (18-36 months)

- Expand across knowledge categories

- Integrate with enterprise workflows

- Develop mobile-first knowledge browsing

Phase 3: Market Leadership (3-5 years)

- Become default knowledge discovery platform

- License SAM-1 to competitors

- Control semantic web infrastructure

Competitive Moats

Technical Superiority:

- Structured knowledge vs. probabilistic text generation

- Verifiable sources vs. training data opacity

- Causal reasoning vs. pattern matching

Business Model Alignment:

- Success depends on user finding valuable information

- Partners benefit from traffic and attribution

- Quality improves with usage (network effects)

Financial Impact Assessment

Market Size:

- Google Search: ~$250B annual revenue

- Knowledge-intensive searches: ~40% = $90B addressable market

- Intellisophic’s potential capture: 15-25% = $9-15B annual revenue

Valuation Implications:

- 5X CTR performance advantage supports premium pricing

- Network effects and switching costs justify high multiples

- Strategic value to prevent Google’s information monopoly

Conclusion

Google’s LLM integration creates the perfect storm for Intellisophic’s market entry:

- User frustration with degraded search quality

- Content creator rebellion against traffic theft

- Enterprise demand for verifiable information

- Regulatory scrutiny of Google’s information monopoly

Intellisophic’s 5X performance advantage, combined with SAM-1’s technical superiority and Google’s self-cannibalization, creates conditions for rapid market share capture in the most valuable segments of the search market.

This positioning transforms the $50B IP exit into a potential $100-300B strategic acquisition to prevent Google’s disruption or enable a competitor to challenge Google’s search dominance.